MTR Corporation

Company Profile

Known as the world's leading rail system, MTR is known for its safety, reliability, superior customer service and efficiency. The average passenger capacity of MTR passengers is close to 5.3 million passengers per week. 99% of passenger journeys will arrive at the destination on time. It is the fastest and most convenient transportation service for passengers travelling to and from Hong Kong and even outside the country.

When it was established in 1975, the mission of the then MTRC was to construct and operate a railway system for Hong Kong, operating on prudent commercial principles and cooperating with local public transport needs. The Hong Kong government was the sole shareholder at the time. In June 2000, the MTRC was registered as a limited company. The Hong Kong SAR Government then sold 23% of the shares of the MTR and went public on the Hong Kong Stock Exchange on October 5, 2000. The company's largest shareholder is the Financial Secretary of the Hong Kong Special Administrative Region, which currently holds 76.11% of the company's shares.

Profit model

MTR Corporation model: Metro + commerce + property portfolio, fully operational mode of operation.

1. Railway related business:

The MTR Corporation is recognized as a world-class public transport agency, maintaining its highest level of international standards in terms of reliability, safety and efficiency. The MTR is the fastest and most convenient network for passengers travelling to and from Hong Kong. The MTR operates nine railway lines: Kwun Tong Line, Tsuen Wan Line, Island Line, Tung Chung Line, Tseung Kwan O Line, Disney Road, Eastern Rail Link and Ma On Shan. West Rail Line and Light Rail Service in the Northwest New Territories. In addition, the MTR also provides an Airport Express to and from the Hong Kong International Airport and intercity passenger services to and from Beijing, Shanghai and Guangdong Province.

2. Property development and investment business:

The property is an important source of income for the MTR Corporation. MTR is mainly working with property developers along its railway network to carry out residential-based property development. The investment properties owned by the MTR Corporation are mainly shopping malls and office buildings, and manage the properties of its properties and other owners. The MTR Corporation's investment property portfolio also includes 12 malls and an 18-storey office building in the International Finance Centre Phase II.

MTR's comprehensive property development model has also expanded to the mainland of China, with development in Beijing, Shenzhen and Tianjin. The pre-sale response of the company's first property development project in the Mainland, "Tianlu", was well received.

3. International business:

The MTR Corporation has taken root in Hong Kong and has gone international, expanding its railway-related business projects in mainland China and overseas. In mainland China, the company participates in the construction and operation of Beijing Line 4, Line 14, Shenzhen Metro Line 4 (Longhua Line) and Hangzhou Metro Line 1. In overseas business, the company is also involved in the management of London's London Underground Railway System London Overground and Crossrail's first service, the Melbourne Railway in Australia, the Stockholm Metro in Sweden, and the MTR Express train to and from Stockholm, Sweden and Gothenburg Intercity Train Service. In addition, the company's consulting services have expanded to include cities in Asia, Australia and the Middle East.

Industry overview

1. China's rail transit industry is still in a stage of rapid development. The number of urban rail transit mileage in China has increased rapidly in the past ten years, and the average annual compound growth rate has reached 25%. Urban rail transit is one of the important contents of new urbanization. Since 2011, urban rail transit projects have increased substantially, and the National Development and Reform Commission has also approved Accelerated, the city rail entered a large-scale construction, and the number of subway depots increased rapidly. As of the end of 2015, there were a total of 111 cities in China with a total of 111 urban rail transit lines. The length of the road network reached 3,286 km. From 2005 to 2015, the compound annual growth rate of urban rail mileage reached 23.7%. From the perspective of total investment, the national total in 2014 The total investment of urban rail transit reached 289.9 billion yuan, and in 2015 it exceeded 300 billion yuan.

The number of urban rail transit vehicles in China from 1998 to 2004

2. The proportion of urban rail transit passenger traffic in China is still at a low level, and the market has huge room for growth. According to the statistics of the Ministry of Transport, the overall proportion of urban rail transit passenger traffic in China has shown an upward trend, which has increased from 3% in 2009 to 10% in 2014, but compared with the developed cities. The first-tier cities in China have a denser population and more congested traffic, but the proportion of subway trips is lower, and the gap between second- and third-tier cities is even more significant.

With the accelerated development of urbanization in China, the scale of urban areas will continue to expand in the future, and rail transit will be an inevitable choice to solve the problem of traffic congestion. According to forecasts, the urbanization rate will reach 60% by 2020, the urban population will increase by 100 million, and by 2020, the number of cities with more than 1 million people will exceed 200, which will drive demand for urban rail transit.

3. As an old-fashioned subway leader, MTR has continued to increase its market share in such a rapidly growing market environment. According to statistics, the MTR's 2015 public transport market share in Hong Kong was 48.5%, compared with 48.1% in 2014. Moreover, as the cooperation between China and Hong Kong continues to rise, the appearance of MTR has also appeared in the construction of rail transit in Beijing, Shenzhen and Hangzhou, and it is believed that the future market share of the MTR will further increase.

Financial overview

1. In 2015, MTR's operating performance was the best year in the past year. The Hong Kong property tendering scheme successfully awarded a number of projects. The pre-sale response of the “Scorpio” in Mainland China was established, and railway operations outside Hong Kong continued to make progress.

2. MTR's revenue in 2015 increased by 3.8% year-on-year, but basic business profit decreased by 5.9% year-on-year. According to the company's performance announcement, the company achieved revenue of 41.701 billion yuan in 2015, an increase of 3.8% over 2014 revenue, mainly due to Hong Kong passenger transportation business income, station business income, Hong Kong property and mainland income, as shown in the following figure. However, basic business profit decreased by 5.9% from 2014 to 10.84 billion.

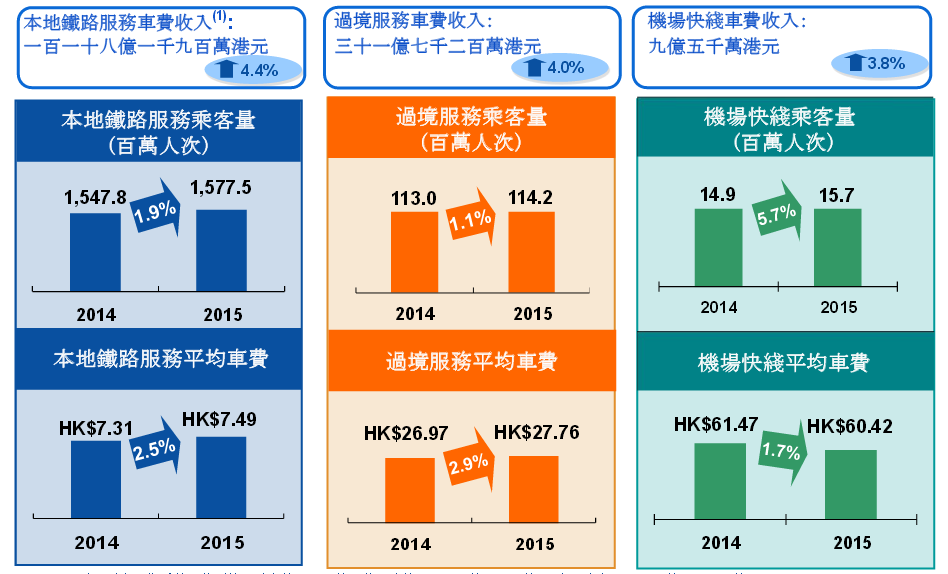

3. The largest proportion of all revenues in Hong Kong's passenger service business increased by 4.3% to 16.916 billion. Among them, Hong Kong's local subway services, transit services and airport expressways all have different proportions of growth.

Advantages and prospects

1. The “Railway and Property Development” business model brings stable income. The business development model of the MTR is the "Railway and Property Integrated Development Management" model. The MTR works hand-in-hand with property developers to build residential and commercial properties at the stations and car factories and adjacent areas. The urban railway network can facilitate the living and commercial activities and develop high-quality communities. The residents of the railway-based communities are also The railway network provides a steady amount of passengers. This business model has proved that the development of the Hong Kong railway network is also an effective method for financing railway construction and for other cities to learn from. In the future, the scale, business scope and geographical coverage of MTR will continue to develop steadily and become increasingly diversified.

2. The “Railway 2.0” program will provide passengers with closer service and improve operational efficiency. In early 2016, the MTR announced the launch of the "Railway 2.0" project, covering a number of important asset renewal plans for the existing railway network (including the provision of over $7 billion for maintenance, renewal and upgrading of the Hong Kong railway network; purchase of 93 trains) and The remaining four railways will be completed in the next few years (Kwun Tong Line, Tsuen Wan Line, Island Line and Tseung Kwan O Line). Upon completion of the project, "Railway 2.0" will provide passengers with a more compact service, a more comfortable environment and a better network to become a truly "new generation" railway network.

Risk and crisis

1. Since the profit of business outside Hong Kong will be converted into Hong Kong dollars, if the local currency trend continues to be weak, its profit performance may be affected.

2. Hong Kong's economic growth has slowed due to the decline in retail sales, the slowdown in the residential property market, the strength of the Hong Kong dollar, and the slow economic growth in Mainland China. MTR's various businesses in Hong Kong have a certain degree of resilience to the slowdown in economic growth, while the new rents for station shops and shopping malls will depend on market conditions. The slowdown in economic growth will have a greater impact on the company's advertising business.

3. The US Federal Reserve also raised the federal funds rate by 25 basis points at the end of 2015, and said that it may raise interest rates again in 2016. In addition, the downward pressure on the Hong Kong economy will increase, both of which will have a negative impact on property prices. Affect the revenue of MTR properties.

company information

Company Name Hong Kong Railway Company Limited

Time to market 2016-11-25

Official website http://www.mtr.com.hk/

management team

Chairman of the Board Ma Shiheng

CEO Liang Guo

Chief Financial Officer Xu Lianghua

Listed exchange

Hong Kong Stock Exchange

Public transportation in the industry

Address MTR Headquarters Building, Telford Plaza, Kowloon Bay, Hong Kong

The largest shareholder, the Financial Secretary of Hong Kong

JULY 11, 2018