Yum Brands Group

Company Profile

Yum! Restaurant, a famous global restaurant group. If you don't know its name, then the two "foreign restaurants" of KFC and Pizza Hut in China are definitely impressive. That's right, they are the "flagship" for the Yum!

Yum! Brands is the world's largest catering company with a total market capitalization of more than $30 billion. It was spun off from the famous PepsiCo in 1997. (But from the company's name, "Yum" and "Pepsi" really have their origins.)) Yum has nearly 42,500 restaurants in more than 130 countries and regions around the world. It is fried chicken, pizza and Mexican food. The global leader, including KFC, Pizza Hut, and Taco Bell, has domestic brands such as "Little Sheep" and "Oriental White".

In October 2015, Yum! announced plans to spin off its China operations and eventually established two independent listed companies, “Yumen China” and “Yumsheng Catering Group”. In April 2016, foreign media reported that a consortium consisting of China Investment Corporation, private equity giant KKR and Baring Private Equity Asia was negotiating with Yum! to purchase Yum’s mainland China business. In other words, once China CIC and Yum! reach an acquisition agreement, these "foreign fast food" will eventually bring "Chinese descent." What prompted the Yum! restaurant spin-off business?

Profit model

In January 2016, after Yum! split the Yum's Indian subsidiary, it had four subsidiaries, namely:

KFC: The world's second largest fast food and largest fried chicken chain, mainly selling fried chicken, burgers, French fries, egg tarts, soft drinks and other high-calorie fast food. KFC is part of the Yum Brands Group and is responsible for all KFC operations except China.

Pizza Hut: Pizza Hut is a pizza chain restaurant, and is responsible for all Pizza Hut businesses except China in the Yum! Group.

Taco Bell: The world's largest Mexican-style restaurant chain, responsible for all Taco Bell businesses in the Yum! Group of restaurants except China.

Yum! China: Responsible for all the business of Yum! Brands in China, including KFC, Pizza Hut, Taco Bell, Oriental White, and the Little Sheep brand. Oriental White is a Chinese fast food brand that is designed for Chinese consumers. Little Sheep is a hot pot chain featuring Little Sheep. Little Sheep was listed in Hong Kong in 2008 and was acquired by Yum! China in 2011.

Industry overview

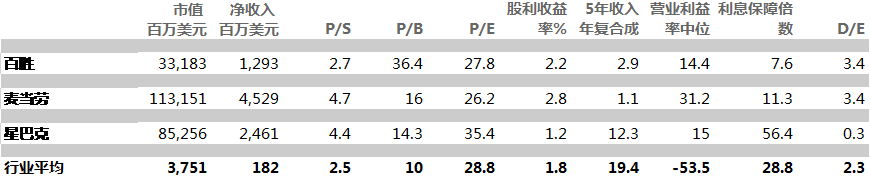

When it comes to KFC’s competitors, everyone will first think of McDonald’s. In fact, in a broad sense, all the food and beverage industries are competitors of Yum! The most common situation in dining is three meals a day. The fixed quantity means that the market capacity is limited. Moreover, if you go out to eat, you can only choose one restaurant for consumption. Therefore, the competition in the catering industry is extremely fierce, which is not without reason. Take the US stocks, for example, there are 170 companies that are listed in the US for catering. The chart below shows the familiar data of McDonald's, Starbucks and Yum!, and gives the industry average.

(Data from Morningstar Real-Time)

As can be seen from the above data, Yum! is not an order of magnitude in terms of market capitalization and net income, and even a far cry from Starbucks. That's right, even if we add up to our familiar KFC and Pizza Hut, plus the stranger Taco Bell, the total market value of the three is better than the "old wheat." Strange, don't you think that KFC's grandfather is like "Mother Brother"? That is a big mistake! This is because KFC is only developing very well in China, and the limelight has even overshadowed McDonald's. This is why Yum! China has to split up and go public. I have to say that our Chinese are really too fond of KFC's grandfather!

From the perspective of stock investment, the yield of Yum! Restaurant is higher than the industry average. Although it is still inferior to McDonald's, it has an advantage over Starbucks.

Financial overview

The chart below shows the revenue and profit statement of Yum! 2010-2015. It is not difficult to find that Yum’s revenue performance is very stable. However, stability is less attractive to investors. The biggest highlight of Yum! in 2015 is the increase in yield. According to the disclosed first quarter 2016 results, Yum's global sales revenue increased by 5%; core operating profit increased by 21%; restaurant profit margin was 22.4%, an increase of 3.5 percentage points.

In the first quarter of 2016, Yum! added 295 restaurants worldwide, of which 72% of international business progress came from emerging markets. It is worth noting that Yum’s China business showed signs of recovery in the first quarter, but it may be due to the financial statistics of the quarter's business covering the Chinese Lunar New Year. In any case, this is a good thing for Yum! to split the Chinese business.

Advantages and prospects

1. For a long time, in order to ensure the consistency and quality of products, Parkson mainly adopts the method of granting franchise rights, that is, the funds are provided by the franchisees, and then Yusheng will deliver the new stores that have already opened for operation to the franchisees. This method can not only meet the requirements of the location, style and other requirements of Yum!, but also allows investors to invest more confidently and willingly pay higher funds for this purpose. It is through this model that KFC has achieved rapid expansion on a global scale.

2. Splitting the Yum! China business will have a huge impact on the future of Yum! After the spin-off of its China business, Yum! plans to establish two independent listed companies, “Yumen China” and “Yumsheng Catering Group”. Judging from the current situation, the split Yum! China will have no obvious liabilities, and will have a large amount of free cash flow, and will have greater autonomy in terms of operations.

However, investors should also see that the stock price of Yum! Brand is actually very dependent on the performance of China's business, whether it is financial or stock price, this is very obvious. For example, Yum’s share price has risen more than sixfold between 2002 and 2012, mainly due to the rapid growth of China’s business at the time. However, due to the continued weak sales in China in recent years, Yum’s share price plummeted in May last year, and by the end of 2015, the cumulative decline was over 20%. It was not until mid-February 2016 that the stock price began to regain its uptrend.

Although Yum's split into China business will help to increase investor confidence, and emerging markets still have endless potential, I believe that it is not appropriate to invest blindly and optimistically because consumers are increasingly inclined to be healthy in the mature market of Yum! Nutritional foods, despite the increase in revenue in the last two quarters, cannot be judged to have fully recovered. In fact, the continuous introduction of products that meet the localization needs is the real guarantee for market growth. If investors favor the stock, please pay close attention to the progress of the spin-off business, which is the most important factor affecting the stock price in the medium term.

Risk and crisis

1. The first place in catering risk is definitely food safety. Yum’s catering as a giant is even more so. The “Fuxi incident” that appeared in China in the early stage has had a great impact on the company’s China business.

2. The Chinese business contributed most of the revenue and profits of Yum! Therefore, Parkson's overall finance is highly dependent on its performance in China. Parkson's China business faces economic conditions (including consumer spending, unemployment, wages, inflation, exchange rates...), consumer preferences, taxation, and regulatory changes.

3. Excessive expansion may result in eroding existing sales or facing the risk that new restaurants may not be profitable.

4. The company's operating performance depends largely on the franchisee and licensing model. If the franchisee or licensee bears too much debt, they increase operating expenses or commodity prices, or the economic and sales trends deteriorate, it will make them difficult. Profits and debt repayments can cause financial crises.

5. The company's splitting of China's business may bring risks: First, it is difficult to split; second, it may not achieve some or all of the expected benefits after the spin-off; in addition, it may face greater tax liability in the United States.

company information

Company Name Yum! Brands, Inc.

Time to market 1997-9-17

Official website http://www.yum.com

management team

Chairman of the Board of Directors Robert D. Walter

CEO Greg Cred

Chief Financial Officer David Gibbs

Listed exchange

New York Stock Exchange

Industry catering

Address United States North Carolina

The largest shareholder of The Vanguard Group